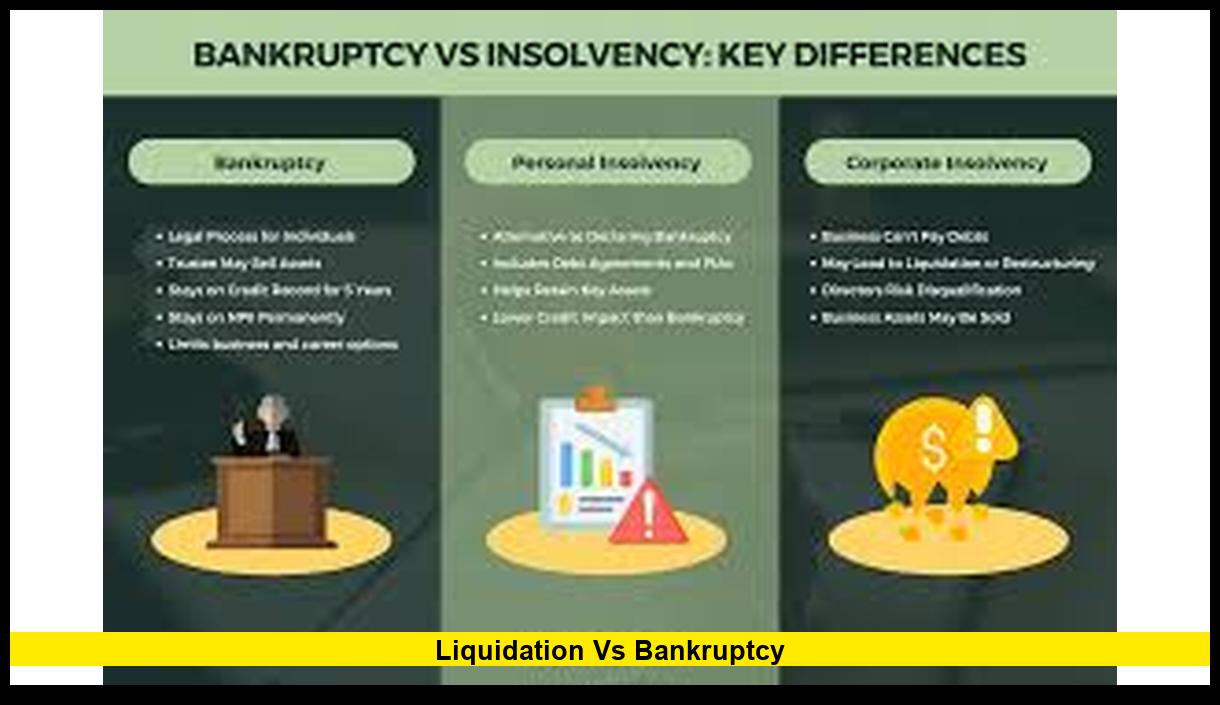

Different Types of Bankruptcies: What They Mean for Your Financial Future

When bills pile up and options feel limited, understanding the different types of bankruptcies can help individuals and businesses choose a structured way to reset their finances. In the United States, bankruptcy is a legal process under federal law that allows people and companies who cannot pay their debts to either eliminate or reorganize what … Read more