Social security changes january 2026 are now fully confirmed and will bring meaningful updates for millions of Americans who rely on monthly benefits. These changes affect retirement benefits, disability payments, Supplemental Security Income, earnings limits, and payroll tax thresholds. All updates discussed here are official, finalized, and scheduled to take effect with January 2026 payments, reflecting the most current status as of today.

This article provides a complete, clear, and factual explanation of what is changing, who is affected, and how these updates may influence household budgets across the United States. Every section stays focused on the keyword and explains only confirmed information.

Confirmed Cost-of-Living Adjustment Takes Effect in January 2026

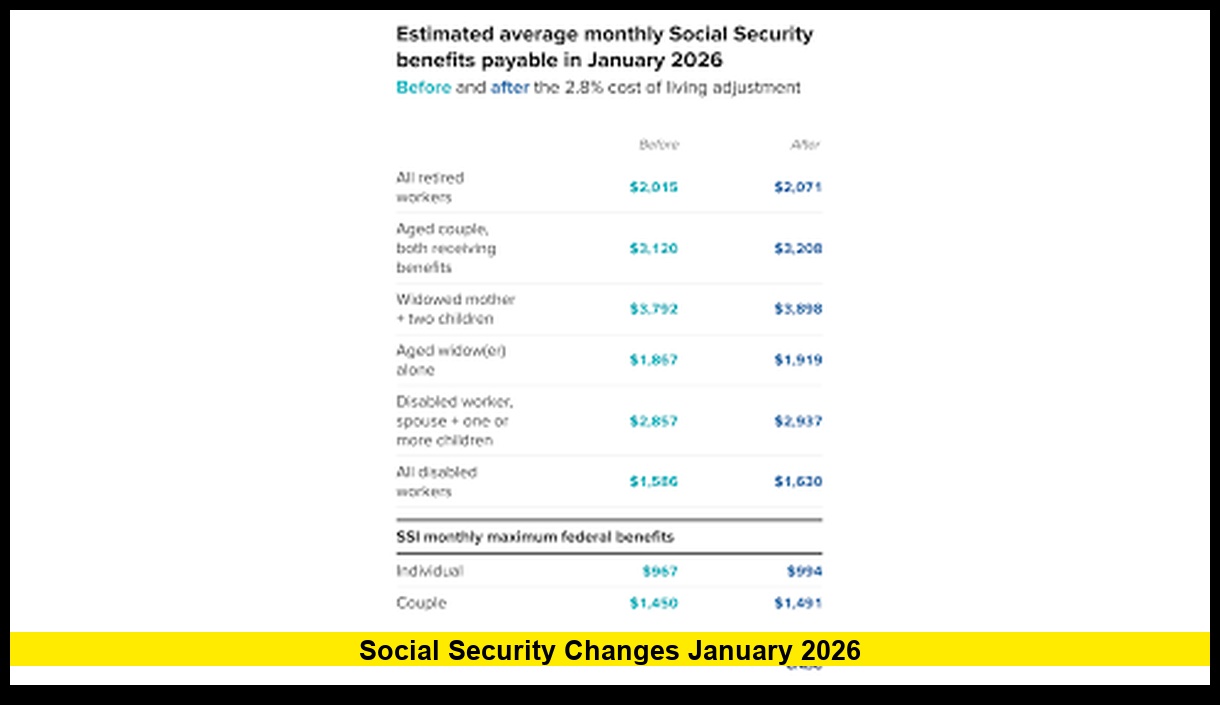

The most important part of the social security changes january 2026 is the officially confirmed 2.8 percent cost-of-living adjustment, commonly known as COLA. This increase applies to Social Security retirement, disability, survivor benefits, and Supplemental Security Income.

The COLA is designed to help benefits keep pace with rising prices for everyday necessities such as food, housing, utilities, transportation, and medical care. The 2.8 percent adjustment reflects inflation levels measured during the most recent evaluation period and is locked in for 2026.

For many beneficiaries, this increase represents a noticeable improvement in monthly income, especially after several years of elevated living costs.

How the 2026 COLA Changes Monthly Retirement Benefits

The COLA increase affects benefit amounts differently depending on an individual’s work history, earnings record, and claiming age. However, the average increases provide a helpful reference point.

After the 2.8 percent adjustment:

- The average retired worker receives a higher monthly payment starting in January 2026

- Couples who both receive benefits see a combined increase

- Survivor and spousal benefits also rise automatically

- Disability benefits increase using the same percentage formula

For retirees living primarily on Social Security income, even a modest percentage increase can help offset rent increases, higher insurance premiums, and rising grocery costs.

Importantly, beneficiaries do not need to apply for the COLA. The increase is automatic and applied by the Social Security Administration.

Supplemental Security Income Payment Levels Increase

Another major element of the social security changes january 2026 involves Supplemental Security Income, commonly known as SSI. SSI is a needs-based program that provides financial assistance to older adults, blind individuals, and people with disabilities who have limited income and resources.

With the 2026 COLA applied:

- The maximum federal SSI payment for individuals increases

- The maximum federal SSI payment for couples increases

- Payments for essential persons also rise

These increases apply nationwide, although some states provide additional supplements that may raise total monthly payments further.

Because SSI eligibility depends on income and resources, beneficiaries should be aware that even a small increase in income from other sources could affect eligibility or payment amounts. However, the federal SSI increase itself does not disqualify recipients.

New Maximum Social Security Benefit for 2026

The social security changes january 2026 also raise the maximum possible Social Security benefit available to individuals who retire at full retirement age with a long history of high earnings.

For 2026:

- The maximum monthly Social Security benefit at full retirement age increases

- This applies only to workers who consistently earned at or above the taxable maximum during their careers

While most beneficiaries receive less than the maximum, this change reflects how the system adjusts benefits to match wage growth and inflation over time.

Higher Taxable Earnings Cap for Workers

One of the most significant behind-the-scenes changes in social security changes january 2026 is the increase in the maximum amount of earnings subject to Social Security payroll taxes.

In 2026:

- Workers pay Social Security taxes on earnings up to a higher annual limit

- Earnings above this limit are not subject to Social Security tax

- Medicare taxes still apply to all earnings

This adjustment primarily affects higher-income workers and employers. The increased cap helps maintain the program’s funding structure by reflecting changes in national wage levels.

For most workers, the payroll tax rate itself does not change. Only the income cap is adjusted.

Updated Earnings Limits for Beneficiaries Who Work

Many Social Security beneficiaries continue working while receiving benefits. The social security changes january 2026 include updated earnings limits that apply to people who have not yet reached full retirement age.

For 2026:

- Beneficiaries under full retirement age can earn up to a higher annual limit before benefits are temporarily withheld

- A higher limit applies during the year a beneficiary reaches full retirement age

- Once full retirement age is reached, there is no earnings limit

If earnings exceed the applicable limit:

- Benefits are reduced temporarily, not permanently

- Withheld benefits are recalculated and credited later through higher monthly payments

This system allows beneficiaries to work while receiving Social Security, while still preserving long-term benefit value.

Disability Program Updates for 2026

Social Security changes taking effect in January 2026 also introduce important updates to disability-related programs, including Social Security Disability Insurance (SSDI). These adjustments are aimed at reflecting current wage levels and providing beneficiaries with greater flexibility to work without risking immediate loss of benefits.

Key updates include:

- Higher Substantial Gainful Activity (SGA) limits, allowing individuals to earn more income while remaining eligible for disability benefits

- Increased trial work period earnings thresholds, giving beneficiaries more room to test their ability to return to work

- Revised income limits for blind and non-blind beneficiaries, ensuring fair and updated eligibility standards

These changes help reduce the risk of benefit disruption for modest earnings and support individuals who want to explore employment opportunities while maintaining critical disability protections.

How Medicare Premiums Interact With 2026 Social Security Changes

While Medicare and Social Security are administered as separate federal programs, they are closely connected for millions of retirees and disabled Americans. This connection exists because Medicare premiums—especially for Part B coverage—are typically deducted directly from monthly Social Security benefit payments. As a result, any increase in Medicare costs can affect the real value of Social Security increases.

In 2026, this interaction becomes especially important as both programs undergo annual adjustments:

- Standard Medicare Part B premiums increase, raising the amount automatically withheld from Social Security checks before benefits are deposited

- Higher premiums may partially offset the Cost-of-Living Adjustment (COLA), meaning some beneficiaries may see smaller net increases than expected

- Actual benefit changes vary by individual, depending on Medicare enrollment status, income-related monthly adjustment amounts (IRMAA), and whether the beneficiary is enrolled in Part B or additional Medicare plans

For beneficiaries enrolled in Medicare Part B, the monthly deposit they receive may rise by less than the headline COLA percentage. In some cases, the premium increase may absorb much of the benefit adjustment, particularly for those with lower Social Security payments or higher Medicare premiums.

Understanding how Medicare premiums interact with Social Security changes is essential for accurate budgeting and financial planning in 2026. Beneficiaries are encouraged to review their Medicare enrollment, monitor premium deductions, and factor in these offsets when estimating their true monthly income for the year ahead.

Impact on Low-Income and Fixed-Income Households

For households that rely heavily on Social Security and SSI, the social security changes january 2026 provide important financial relief, but challenges remain.

Positive impacts include:

- Higher monthly income to offset inflation

- Increased SSI payments for vulnerable populations

- Better alignment between benefits and living costs

However, many beneficiaries still face rising housing costs, healthcare expenses, and utility bills that outpace benefit growth. The COLA helps, but it does not eliminate financial pressure entirely.

Payment Timing and January 2026 Distribution

The updated benefit amounts are reflected in January 2026 payments for Social Security recipients. SSI recipients typically receive their adjusted payments slightly earlier due to calendar scheduling.

Key points to remember:

- Payment dates are based on birth dates

- Early payments may occur if holidays or weekends fall on regular pay dates

- The increased amounts apply automatically

Beneficiaries can confirm their updated benefit amount through official account access before payments are issued.

Why These Changes Matter for Retirement Planning

The social security changes january 2026 are not just short-term adjustments. They influence long-term financial planning for retirees, near-retirees, and disabled individuals.

Important considerations include:

- Estimating net income after Medicare deductions

- Understanding how working affects benefits before full retirement age

- Planning around updated SSI thresholds

- Coordinating Social Security with other income sources

Even small changes can have compounding effects over time, especially for individuals who rely on Social Security as their primary income source.

Clarifying Common Misunderstandings About the 2026 Changes

Several misconceptions often arise when Social Security updates are announced.

Clarifications include:

- The COLA does not require an application

- Benefits are not reduced permanently for working before full retirement age

- The payroll tax increase affects income caps, not tax rates

- SSI increases do not automatically remove eligibility

Understanding these details helps beneficiaries avoid unnecessary worry and misinformation.

What Has Not Changed in January 2026

While the social security changes january 2026 include several important updates, some aspects of the program remain the same:

- Full retirement age rules are unchanged

- Benefit formulas remain intact

- Eligibility requirements are consistent

- Spousal and survivor benefit structures continue

This stability ensures predictability for beneficiaries while allowing necessary adjustments tied to economic conditions.

Looking Ahead Beyond January 2026

Although January 2026 changes are finalized, broader discussions about the future of Social Security continue nationwide. These discussions do not affect the confirmed updates described here but remain part of long-term policy conversations.

For now, beneficiaries can rely on the confirmed increases and adjustments taking effect in 2026.

How Beneficiaries Can Prepare for the 2026 Changes

To make the most of the social security changes january 2026, beneficiaries may consider:

- Reviewing updated benefit notices

- Adjusting monthly budgets

- Monitoring Medicare premium deductions

- Tracking earnings if working while receiving benefits

Preparation helps ensure financial stability and avoids surprises when new payment amounts arrive.

Why the 2026 Updates Are Especially Significant

The 2026 adjustments stand out because they follow a period of persistent inflation and economic uncertainty. The confirmed COLA and related changes reflect efforts to maintain purchasing power for millions of Americans.

For retirees, disabled workers, survivors, and low-income individuals, these updates play a crucial role in maintaining financial security.

Summary of Key Social Security Changes January 2026

To recap, the confirmed updates include:

- A 2.8 percent COLA increase

- Higher monthly retirement and disability benefits

- Increased SSI federal payment levels

- A higher taxable earnings cap

- Updated earnings limits for working beneficiaries

- Adjusted disability thresholds

- Medicare premium interactions affecting net payments

Each change is automatic and based on established formulas.

Social Security changes January 2026 will affect millions of households in real and lasting ways, and understanding them now can help you plan with confidence—share your thoughts or questions below and stay connected for future updates.