Understanding liquidation vs bankruptcy has become increasingly important as U.S. businesses face financial pressure in 2025. Corporate bankruptcy filings continue to rise across multiple sectors, and several major companies have recently entered restructuring or asset-sale processes. These developments highlight why Americans need clarity on the difference between liquidation and bankruptcy and how each process affects workers, creditors, and local economies.

Bankruptcy filings from well-known brands in food production, aviation, and restaurants throughout 2025 have brought greater public attention to the steps companies take when they can no longer manage their debt loads. These real-time events make it essential for consumers, investors, and business owners to understand what liquidation is, how bankruptcy works, and how the two terms connect.

What Bankruptcy Means in the United States

Bankruptcy is a formal legal process that helps individuals or businesses reorganize or eliminate debt while under federal court supervision. It offers protection from collection efforts and provides a structured path toward resolving financial obligations.

Bankruptcy comes in several forms, each serving a different purpose:

- Chapter 7: Often called liquidation bankruptcy. A court-appointed trustee sells nonexempt assets to repay creditors, and the business usually shuts down after the process is complete.

- Chapter 11: A reorganization option primarily for businesses. Operations can continue while the company restructures its debts, negotiates with creditors, and seeks a sustainable path forward.

- Chapter 13: A repayment plan for individuals who want to restructure debt and pay it over time while keeping their assets.

In 2025, the number of bankruptcy filings across the country has continued to rise due to economic pressure from higher interest rates, increased operating costs, and slowing consumer demand. Many companies have entered Chapter 11 to restructure debt, while others have opted for Chapter 7 when recovery is not feasible.

Bankruptcy gives financially distressed entities a legal shield while they regroup or wind down. It also ensures creditors are treated fairly through a structured, court-monitored process.

What Liquidation Means

Liquidation is the process of converting a company’s assets into cash to repay creditors. It can occur as part of a bankruptcy case—most commonly Chapter 7—or through other legal mechanisms, depending on state law and the company’s structure.

Key features of liquidation include:

- A trustee or authorized representative sells assets such as equipment, property, inventory, or intellectual property.

- Proceeds are distributed to creditors in a specific order set by law.

- After liquidation is complete, the business usually closes permanently.

Liquidation focuses solely on selling assets. It is not designed to rescue or rehabilitate a company. Unlike Chapter 11, there is no reorganization plan or future operating strategy. The goal is to maximize value for creditors using remaining assets.

In some cases, companies pursue liquidation outside of federal bankruptcy court. This can occur through state-based processes or voluntary assignments, though these avenues still prioritize repaying creditors as efficiently as possible.

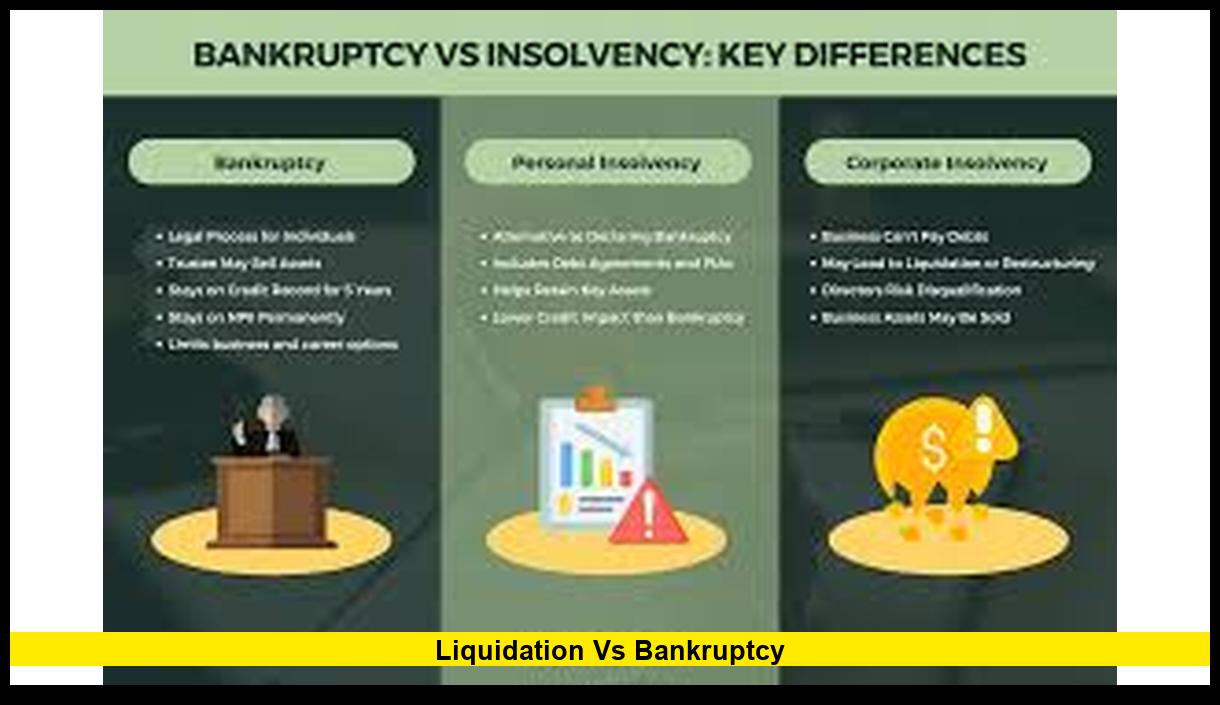

Liquidation vs Bankruptcy: Understanding the Difference

Although the terms are related, they do not mean the same thing. Liquidation is a process, while bankruptcy is a legal status.

Key Distinctions

| Feature | Liquidation | Bankruptcy |

|---|---|---|

| Core Purpose | Sell assets to pay creditors | Reorganize or eliminate debt |

| Court Involvement | Required only if inside bankruptcy | Always occurs under court supervision |

| Business Operations | Typically cease | May continue under Chapter 11 |

| Process Type | Asset conversion | Legal protection and debt resolution |

| Trustee Role | Oversees liquidation in bankruptcy cases | Required for Chapter 7, optional for Chapter 11 |

Bankruptcy can include liquidation, but liquidation does not always require bankruptcy. In bankruptcy, liquidation is just one potential outcome. Some companies reorganize instead of shutting down. Others use liquidation to complete an orderly wind-down when recovery is not possible.

Current Trends: Why This Distinction Matters in 2025

The economic landscape in 2025 has made the differences between liquidation and bankruptcy especially relevant. Many companies facing mounting debt have entered Chapter 11 to restructure while remaining operational. Others, unable to secure financing or reduce expenses, have moved directly into asset liquidation.

Industries such as food manufacturing, aviation, and hospitality have seen a noticeable uptick in bankruptcy cases this year. Some companies have pursued reorganization strategies, while others have begun selling assets through court-supervised liquidation.

These developments matter because:

- Employees may lose their jobs entirely in liquidation, while Chapter 11 can preserve positions.

- Creditors often recover more through reorganization than liquidation, depending on the company’s viability.

- Local economies feel the impact differently when a business shuts down rather than restructures.

- Investors must understand the implications for equity, which is usually wiped out in liquidation.

With economic volatility still affecting several sectors, the distinction helps stakeholders understand what to expect when a company announces financial trouble.

How Liquidation Works Inside Bankruptcy

In a Chapter 7 case:

- A trustee evaluates assets, sells what is allowed by law, and distributes funds to creditors.

- Secured creditors are paid first, followed by priority and unsecured creditors.

- Most businesses cease operations immediately or shortly after filing.

- Any remaining eligible debts may be discharged.

In some Chapter 11 cases, companies choose to liquidate through a structured plan when reorganization is no longer practical. This is known as a Chapter 11 liquidation plan. Although different from Chapter 7, the goal is the same: convert all assets to cash and close the business.

Why Consumers and Businesses Should Pay Attention

Understanding liquidation and bankruptcy helps Americans navigate today’s financial climate. Whether you are a business owner evaluating options, an employee monitoring your employer’s financial health, a creditor assessing risk, or a consumer trying to interpret business news, knowing the difference provides clarity.

Bankruptcy offers a chance for recovery.

Liquidation signals an ending.

Both processes play important roles in the U.S. financial system, but they lead to very different outcomes for everyone involved.

If you have insights or questions about how liquidation vs bankruptcy affects today’s business climate, feel free to share your thoughts below.