The topic of stimulus check IRS updates is dominating conversations again as tax season unfolds in the U.S., but what is true and what isn’t? Rumors about new federal payments, direct deposits, or large one-time stimulus checks have been circulating widely online, causing confusion. Stay with this guide to learn what the Internal Revenue Service is actually doing, including how tax refunds and other payments are being handled in early 2026, and what the IRS has officially announced so far.

If you’re looking for clear and factual updates about IRS payments and your tax season, keep reading to stay informed.

No New Federal Stimulus Checks Approved for 2026

One of the biggest questions Americans are asking this year is whether the IRS or Congress has authorized a new federal stimulus check program in 2026. Despite widespread headlines and social media posts claiming that the Internal Revenue Service will send universal payments—such as a $2,000 check—there has been no official announcement of any new stimulus check for all taxpayers.

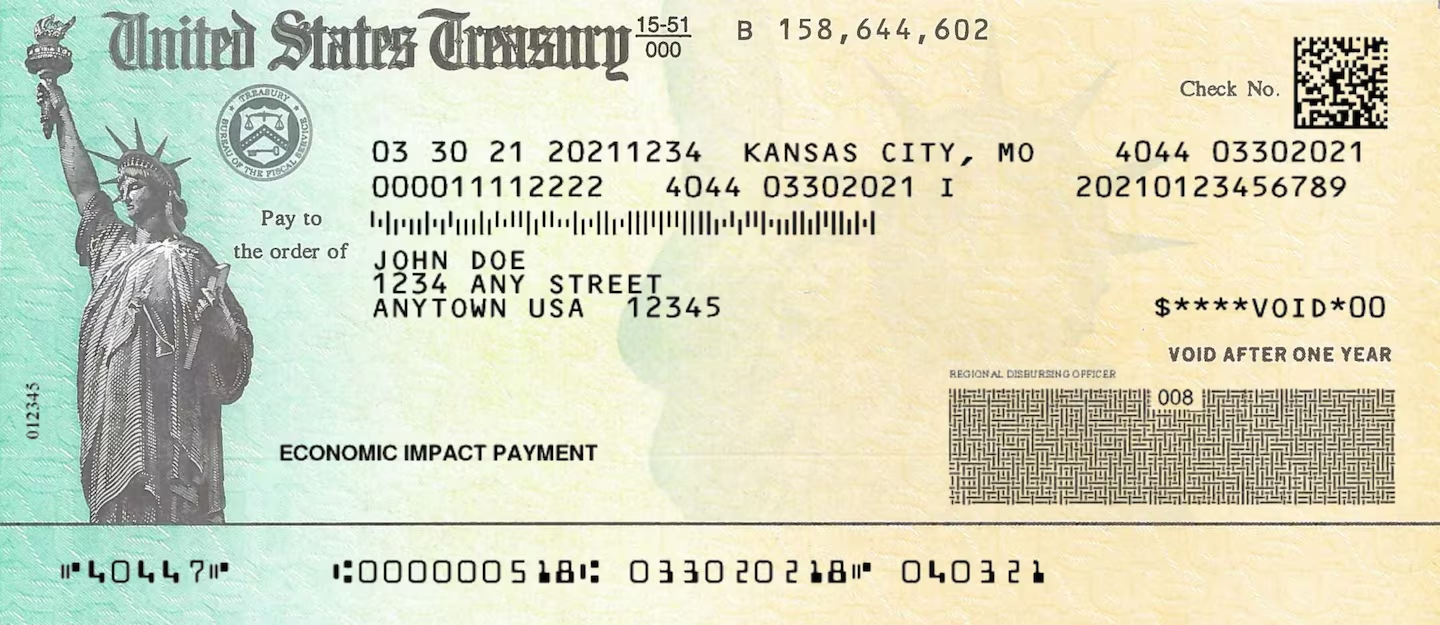

Government and IRS channels show that the last round of direct economic-impact payments was distributed during the COVID-19 relief period, ending in 2021 with the third payment. Recent attention around supposed stimulus checks in early 2026 stems largely from online rumors, not an actual federal payment plan approved by Congress or the IRS. Rumors specifically referencing new direct deposit stimulus checks show up frequently on social platforms, but the U.S. tax agency has not issued any new program outlining such payments.

In other words, there is no new federal stimulus check program currently scheduled for 2026 that would guarantee a one-time payment to all or most taxpayers. The IRS continues to process regular tax refunds and administer tax credits, but nothing has replaced or revived the broad economic impact payments trend from 2020–2021.

Why Stimulus Rumors Keep Circulating

Speculation about IRS stimulus check payments often resurfaces around the tax filing season for a few reasons:

- Tax refunds and credits, which many taxpayers await during February and March, cause people to closely watch their bank accounts and IRS status tools.

- Rumors about direct deposit payments tied to tariffs or rebate plans circulate on social media, sometimes linked to proposals from political figures.

- Scams and misleading headlines can be mistaken for official IRS action.

For instance, some posts have tied comments from political leaders about tariff dividends to the idea of $2,000 personal payments, but such proposals have not become law or IRS programs. While political figures may discuss ideas for one-time rebates funded by tariffs or other mechanisms, those discussions don’t equate to signed legislation or IRS authorization.

It’s important to separate political commentary from what the IRS is actually implementing and distributing.

IRS and Tax Refunds in 2026

While there are no standalone stimulus checks this year, the IRS is actively processing tax refunds as part of the 2026 filing season. The agency officially opened tax processing in late January, and refund timing is now one of the main financial events affecting taxpayers.

Key Refund Timing Notes

- If you filed electronically with direct deposit early in the season, refunds may start arriving in mid- to late-February.

- Paper check refunds take longer, often into late March or April, because of slower mail and processing times.

- The IRS has phased out most paper refund checks, shifting toward direct deposit and electronic delivery for efficiency and security.

This shift is part of a broader effort under a federal executive order and IRS policy to modernize payment systems, reducing reliance on mailed checks and increasing the use of secure electronic transfers.

Taxpayers should review their refund status via the IRS Where’s My Refund? tool or the IRS2Go mobile app for the most current information specific to their return.

Federal Payments: What the IRS Is Actually Doing

Aside from regular refunds, the IRS and Treasury Department are pursuing a few ongoing or new administrative efforts that can affect taxpayers:

Modernizing Payments

The IRS is implementing changes to how federal payments are delivered, focusing on:

- Expanding direct deposit and electronic payment methods.

- Phasing out paper checks for refunds and other disbursements where possible.

- Supporting alternative electronic payment options for those without traditional bank accounts.

This modernization is meant to slash payment delays, lower potential for fraud, and help taxpayers get their funds faster.

Tax Credits and Filing Resources

The IRS is also promoting awareness of existing tax benefits that can put money in taxpayers’ pockets legally and permanently, such as:

- Earned Income Tax Credit (EITC)

- Child Tax Credit adjustments under current tax law

- Tax counseling grants for elderly taxpayers and volunteer support programs

These credits aren’t “stimulus checks,” but they can increase refunds for eligible households.

Scams and Misinformation to Watch For

With so many rumors about IRS stimulus check payments swirling online, it’s no surprise that scammers are trying to exploit confusion. The IRS continually warns taxpayers to be wary of communications that claim:

- You’re about to receive a huge federal payment without filing taxes

- You must click a link or provide personal data to get an IRS stimulus check

- The IRS will send money through unconventional channels like texts or social media messages

The tax agency never initiates contact through social media or texting to notify taxpayers of payments or required actions. If you receive suspicious messages about stimulus checks or deposits, treat them as potential fraud attempts and avoid clicking links or sharing personal information.

Keeping your bank and contact information current with the IRS, and checking refund or credit status through official IRS tools, remains the safest way to see legitimate payment activity.

State Payments and Local Rebates

While the federal IRS has not initiated a new stimulus check program in 2026, some state governments continue to offer their own rebate or tax rebate programs. These vary by state and can include:

- Refunds from state tax over collections

- Property tax rebate programs

- Income tax credit incentives

- Other local financial relief initiatives

If you live in a state offering such programs, those can affect your net tax benefit in addition to federal refunds, but they are not IRS federal stimulus checks.

How to Prepare and What to Expect

Given the current environment, here are practical tips for taxpayers this year:

- File your federal tax return early and accurately to secure your refund sooner.

- Provide direct deposit information to avoid mail delays and reduce fraud risk.

- Use official IRS tools to track refunds and account notices.

- Be skeptical of social media claims about new IRS stimulus checks without official documentation.

- Explore state rebate programs that may offer additional money beyond federal refunds.

Staying informed and vigilant helps taxpayers maximize refunds and avoid scams while navigating the ongoing tax filing and payment season.

Thanks for reading — feel free to share your thoughts below or check back soon as the IRS updates tax and refund details this season!