When it comes to navigating the complexities of tax filings, IRS audits, or aggressive collections calls, Honest Tax has become a trusted name in the tax assistance industry. With a dedication to transparent and ethical services, Honest Tax provides a comprehensive range of solutions tailored to meet the needs of individuals and businesses alike. This blog explores “Honest Tax Reviews,” delving into its services, reputation, customer feedback, and expert advice. By reading this article, you’ll gain insight into why Honest Tax is a recognizable and reliable name in the tax assistance world, backed by reviews from platforms like Better Business Bureau®, Yelp, Trustpilot, and Glassdoor. We’ll also provide real-life examples to highlight the company’s impact on customers’ tax problems.

About Honest Tax

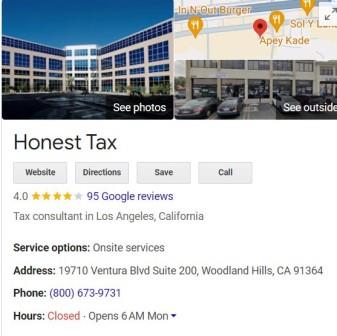

Honest Tax, established to offer clients a lifeline during challenging tax situations, is a well-recognized firm offering a wide range of tax services. From resolving IRS audits to stopping aggressive collection calls, the company provides personalized strategies to meet each client’s specific needs. Headquartered in Woodland Hills, California, and serving clients across the U.S., Honest Tax has built a solid reputation for its customer-first approach.

Accredited by the Better Business Bureau® since 2017, Honest Tax operates with the core principles of transparency, ethical practice, and client satisfaction. Through a mix of tax attorneys, enrolled agents, and certified public accountants (CPAs), the firm provides a multi-disciplinary approach to solving tax problems, making them a leading figure in the industry.

A Trusted and Recognizable Name in Tax Assistance

Honest Tax has earned its place as a trusted name in tax assistance, consistently receiving positive reviews from clients across various platforms. On Yelp, customers highlight the firm’s ability to make the tax process smoother, particularly when it comes to complex situations like audits or tax debts. Honest Tax’s clients appreciate the firm’s deep understanding of tax laws and its focus on providing clear, actionable advice.

For instance, one client from Trustpilot praised the firm for helping them reduce an overwhelming tax debt by negotiating with the IRS on their behalf. Although some customers reported frustrations related to communication delays, the majority of clients express their satisfaction with the firm’s results-driven approach.

Honest Employees Who Care About You

A standout feature of Honest Tax is its dedicated team of professionals who genuinely care about their clients’ financial well-being. The firm’s tax attorneys, CPAs, and enrolled agents go beyond just resolving tax issues—they seek to provide peace of mind.

Many Glassdoor reviews show that employees are happy with the company’s mission, which translates into how they interact with clients. One particular review mentioned how the team at Honest Tax helped explain a client’s IRS situation in layman’s terms, making an otherwise stressful event manageable.

Despite some isolated negative feedback, where clients have mentioned delays in communication, Honest Tax remains committed to understanding the nuances of each client’s case and providing personalized assistance.

Honest Tax Helps Stop Aggressive Collections Calls

One of the biggest reliefs for taxpayers is the ability to stop aggressive collections calls, and Honest Tax excels in this area. By intervening with the IRS on behalf of its clients, the firm can help prevent harassing calls, wage garnishments, and asset seizures.

For example, a business owner shared on Yelp that Honest Tax successfully negotiated with the IRS to halt collections efforts while arranging a manageable payment plan. This allowed the client to continue operating their business without the burden of constant harassment from tax authorities.

Get Help with an IRS Audit from Professional Tax Attorneys

Facing an IRS audit can be nerve-wracking, but Honest Tax offers expert guidance to navigate this process. The firm’s tax attorneys are experienced in dealing with audits, ensuring that clients’ rights are protected and that the audit process proceeds smoothly.

A client from Trustpilot detailed how Honest Tax helped them through a daunting audit. The firm’s attorney was able to identify discrepancies in the IRS’s assessment, ultimately saving the client thousands of dollars in penalties. This real-life example highlights the critical role that tax attorneys at Honest Tax play in ensuring clients receive fair treatment during audits.

Release Liens or Levies and Stop Wage Garnishment with Help from the Pros

In addition to stopping aggressive collections calls, Honest Tax helps clients release IRS liens or levies and prevent wage garnishments. With tax attorneys who negotiate directly with the IRS, clients are able to regain financial control and avoid severe consequences like property seizures or paycheck reductions.

For example, one client described on Glassdoor how Honest Tax managed to lift a levy on their bank account after negotiating with the IRS. This real-life success story showcases the firm’s capability in protecting client assets from further harm.

Honest Tax Provides a Variety of Services

Honest Tax is not just about solving one problem—it offers a range of tax solutions to address varying needs. The firm’s services include tax preparation, IRS audit representation, tax debt resolution, and penalty abatement, ensuring that clients receive the help they need, no matter the tax issue.

Whether you’re a small business facing IRS scrutiny or an individual dealing with mounting tax debt, Honest Tax tailors its services to fit your unique financial circumstances.

Bottom Line

Honest Tax has proven itself as a leader in the tax assistance industry. With a dedicated team of professionals, a commitment to ethical practices, and a proven track record, Honest Tax is well-equipped to help individuals and businesses facing tax challenges. While there are occasional negative reviews about communication issues, the firm’s success stories far outweigh the complaints.

For those seeking tax assistance, Honest Tax offers peace of mind, expert representation, and long-term solutions that address your tax concerns.

See Also- Hurricane Tax Reviews: A Comprehensive Guide to Understanding Their Tax Relief Services

Frequently Asked Questions

What is the most reliable tax website?

The IRS website is the most reliable for tax information, but firms like Honest Tax provide excellent assistance for resolving issues.

Who is the CEO of Honest Tax?

The CEO of Honest Tax is Brandon Edwards, leading the company with a focus on ethical tax solutions.

Let’s Summarize…

Honest Tax provides a wide range of tax services, including IRS audit representation, stopping collections calls, and resolving tax debts. Its team of professionals, including tax attorneys and CPAs, is dedicated to offering transparent, personalized, and effective solutions. Honest Tax has received mixed reviews, but its commitment to client satisfaction is evident across platforms like Better Business Bureau®, Yelp, Trustpilot, and Glassdoor.

1 thought on “Honest Tax Reviews: A Trusted and Comprehensive Name in Tax Assistance”