Managing debt can be an arduous task, especially when you’re facing overwhelming financial obligations. Chapter 13 bankruptcy offers a structured path to manage and repay your debts without losing your property. This article delves into how a Chapter 13 repayment plan works and provides practical examples to illustrate its benefits for improving your monthly budget.

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as a wage earner’s plan, allows individuals with a regular income to develop a plan to repay all or part of their debts over three to five years. Unlike Chapter 7 bankruptcy, which involves liquidating assets to pay off debts, Chapter 13 focuses on reorganization and repayment, enabling debtors to keep their property.

Key Features of Chapter 13 Bankruptcy

- Debt Consolidation: Consolidates multiple debts into a single monthly payment.

- Protection from Creditors: An automatic stay prevents creditors from pursuing collections.

- Asset Retention: Allows debtors to keep significant assets like homes and cars.

- Structured Repayment: Debts are repaid based on income, expenses, and repayment ability.

How a Chapter 13 Repayment Plan Works

A Chapter 13 repayment plan involves several steps, each designed to help you manage your debts effectively.

Step-by-Step Process

- Filing the Petition: The process begins with filing a petition with the bankruptcy court, along with a proposed repayment plan.

- Automatic Stay: Filing the petition triggers an automatic stay, halting most collection activities against you.

- Plan Approval: The court reviews and approves your repayment plan, considering your financial situation.

- Monthly Payments: You make monthly payments to a bankruptcy trustee, who distributes the funds to creditors.

- Completion and Discharge: Upon successful completion of the plan, any remaining eligible debt is discharged.

Components of the Plan

- Priority Debts: Must be paid in full, including taxes and child support.

- Secured Debts: Payments on secured debts like mortgages and car loans may be adjusted.

- Unsecured Debts: Typically paid after priority and secured debts, possibly at a reduced amount.

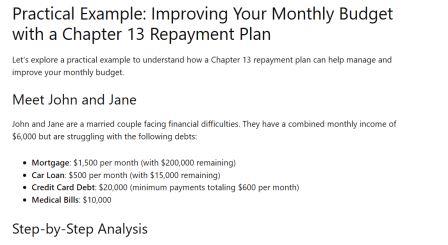

Practical Example: Improving Your Monthly Budget with a Chapter 13 Repayment Plan

Let’s explore a practical example to understand how a Chapter 13 repayment plan can help manage and improve your monthly budget.

Meet John and Jane

John and Jane are a married couple facing financial difficulties. They have a combined monthly income of $6,000 but are struggling with the following debts:

- Mortgage: $1,500 per month (with $200,000 remaining)

- Car Loan: $500 per month (with $15,000 remaining)

- Credit Card Debt: $20,000 (minimum payments totaling $600 per month)

- Medical Bills: $10,000

Step-by-Step Analysis

- Filing for Chapter 13: John and Jane file for Chapter 13 bankruptcy. They propose a five-year repayment plan to manage their debts while retaining their home and car.

- Creating the Repayment Plan:

- Priority Debts: They owe $5,000 in back taxes and $1,000 in child support, which must be paid in full over the plan period.

- Secured Debts: Mortgage and car loan payments continue, but they negotiate lower interest rates.

- Unsecured Debts: Credit card debt and medical bills fall under this category, with a portion of these debts being repaid.

- Monthly Payment Calculation:

- Priority Debts: $5,000 (taxes) + $1,000 (child support) = $6,000 total, or $100 per month.

- Secured Debts: Mortgage and car loan payments continue as usual ($2,000 per month).

- Unsecured Debts: Based on their income and expenses, they agree to pay 30% of the total $30,000 unsecured debt, equaling $9,000 over five years, or $150 per month.

- Total Monthly Payment: $100 (priority) + $2,000 (secured) + $150 (unsecured) = $2,250 per month to the bankruptcy trustee.

Budget Comparison

Before Chapter 13:

- Total monthly debt payments: $2,600 (mortgage, car loan, credit cards)

- Other expenses: $2,500

- Total monthly outflow: $5,100

- Remaining income: $900

After Chapter 13:

- Total monthly debt payments: $2,250

- Other expenses: $2,500

- Total monthly outflow: $4,750

- Remaining income: $1,250

Benefits of the Plan

- Lower Monthly Payments: Consolidating debts and reducing interest rates lower their monthly payments from $2,600 to $2,250.

- Increased Disposable Income: Their remaining income increases from $900 to $1,250, providing more flexibility for living expenses and savings.

- Debt Management: The structured repayment plan helps them manage and eventually eliminate their debt, providing a clear path to financial stability.

Additional Benefits of Chapter 13

Protecting Your Home and Car

One of the significant advantages of Chapter 13 bankruptcy is the ability to protect your home and car from foreclosure or repossession. By including these secured debts in the repayment plan and making consistent payments, you can prevent losing essential assets.

Managing High-Interest Debt

Chapter 13 allows you to reorganize high-interest debt, such as credit card balances. By negotiating lower interest rates or extending the repayment period, you can reduce the overall financial burden.

Psychological Relief

Facing overwhelming debt can be stressful. Chapter 13 provides a structured plan, giving you peace of mind and a clear roadmap to financial recovery.

Credit Score Recovery

While filing for bankruptcy impacts your credit score, Chapter 13 allows you to demonstrate financial responsibility through consistent, on-time payments. This can aid in rebuilding your credit over time.

Steps to Implement a Chapter 13 Repayment Plan

Assess Your Financial Situation

Begin by thoroughly assessing your financial situation. List all your debts, income, and monthly expenses. Understanding your financial landscape is crucial for developing a feasible repayment plan.

Consult a Bankruptcy Attorney

Bankruptcy laws are complex, and a professional can help you navigate the process. A bankruptcy attorney will assist in filing your petition, developing your repayment plan, and representing you in court.

Develop a Realistic Budget

Work with your attorney to create a realistic budget that accommodates your essential expenses while meeting your repayment obligations. This budget will form the basis of your Chapter 13 plan.

File Your Petition

Once your plan is ready, file your petition with the bankruptcy court. This includes submitting detailed financial documents and your proposed repayment plan.

Begin Making Payments

Upon court approval, start making your monthly payments to the bankruptcy trustee. Ensure timely payments to avoid complications and ensure successful completion of the plan.

Common Misconceptions About Chapter 13

“I’ll Lose Everything”

Chapter 13 is designed to help you keep your assets while repaying your debts. Unlike Chapter 7, which involves liquidating assets, Chapter 13 focuses on reorganization and repayment.

“It Will Ruin My Credit Forever”

While bankruptcy does affect your credit score, Chapter 13 allows for credit rebuilding through consistent repayment. Many find their credit improves significantly after completing the plan.

“I Can’t Afford It”

Chapter 13 tailors the repayment plan to your financial situation. By consolidating debts and potentially reducing interest rates, it often results in more manageable monthly payments.

“It’s Only for People with Steady Income”

While regular income is required, it doesn’t mean you need a high income. The court assesses your ability to repay based on your unique financial situation, making Chapter 13 accessible for many.

Case Study: A Real-Life Example

Meet Sarah

Sarah is a single mother with two children. She has a steady job but struggles with substantial medical bills, credit card debt, and a car loan. Her monthly income is $4,000, but her debt payments total $2,200, leaving her with little room for essential expenses.

Filing for Chapter 13

Sarah decides to file for Chapter 13 bankruptcy. Here’s how her repayment plan is structured:

- Priority Debts: $4,000 in back taxes, to be paid over five years ($67 per month).

- Secured Debts: Her car loan remains at $400 per month, but the interest rate is reduced.

- Unsecured Debts: $15,000 in credit card debt and $10,000 in medical bills. She agrees to pay 25%, totaling $6,250 over five years ($104 per month).

Monthly Payment Breakdown

- Priority Debts: $67

- Secured Debts: $400

- Unsecured Debts: $104

- Total Monthly Payment: $571

Budget Comparison

Before Chapter 13:

- Total monthly debt payments: $2,200

- Other expenses: $2,000

- Total monthly outflow: $4,200

- Remaining income: -$200

After Chapter 13:

- Total monthly debt payments: $571

- Other expenses: $2,000

- Total monthly outflow: $2,571

- Remaining income: $1,429

Results

Sarah’s monthly payments drop from $2,200 to $571, giving her a substantial increase in disposable income. With the remaining income of $1,429, she can now comfortably cover her essential expenses and even save for future needs.

Conclusion

A Chapter 13 repayment plan offers a viable solution for individuals struggling with debt, providing a structured path to manage and repay debts while retaining significant assets. By consolidating debts, reducing interest rates, and creating a manageable repayment schedule, Chapter 13 can significantly improve your monthly budget and financial stability. If you’re facing overwhelming debt, consulting with a bankruptcy attorney and exploring Chapter 13 might be the key to regaining control of your finances and achieving long-term financial health.

Great read about Chapter 13 and how it helps in realigning your monthly budget. I’ve heard about Chapter 7, but this gave new insights into keeping property while managing debts.

Can you share how this plan might affect one’s credit rating in the short term? Also, for similar tips and financial comparisons, I find https://world-prices.com quite helpful, although I’m not always sure about their data’s timeliness. Thanks for the info!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/bn/register-person?ref=UM6SMJM3