Facing tax-related challenges can be incredibly overwhelming, especially when dealing with the IRS. Unpaid taxes, audits, and potential penalties can create a maze of stress and confusion. This is where an experienced IRS tax attorney becomes invaluable. J. David Tax Law Reviews stands out as a leading firm, offering expert guidance and tailored solutions to individuals and businesses struggling with tax issues. In this blog, we’ll explore the services provided by J. David Tax Law, examine their client reviews across various platforms, and delve into real-life success stories that showcase the firm’s effectiveness. We’ll also address common questions, empowering you with the knowledge needed to make informed decisions about your tax situation.

J. David Tax Law: Client-Focused Solutions for Your IRS Tax Problems

At J. David Tax Law, the primary focus is on providing personalized and client-centric solutions. Their team of skilled IRS tax attorneys has a deep understanding of both federal and state tax laws, which allows them to offer customized strategies for a variety of tax-related issues. Whether you’re dealing with unpaid taxes, facing an audit, or struggling with tax liens and levies, J. David Tax Law can help you navigate these challenges with confidence.

Here are some of the key services offered by J. David Tax Law:

- Tax Debt Relief: J. David Tax Law works diligently to reduce your tax burden, whether it involves back taxes, penalties, or interest. They explore options like installment agreements or offers in compromise to help you manage your tax debt effectively.

- IRS Audits: An IRS audit can be a daunting experience. The attorneys at J. David Tax Law provide comprehensive representation throughout the audit process, ensuring that your rights are protected and advocating for the most favorable outcome possible.

- Tax Liens and Levies: Tax liens and levies can have a significant impact on your financial stability. J. David Tax Law can help you challenge these actions and explore solutions that safeguard your assets.

- Unfiled Tax Returns: Falling behind on tax filings can lead to severe penalties. J. David Tax Law assists clients in catching up on past-due filings and minimizing potential liabilities.

Building Trust: Detailed Reviews by Renowned Platforms

J. David Tax Law has established a strong reputation for providing exceptional legal services to clients facing IRS-related issues. This reputation is reflected in the numerous positive reviews the firm has received across various online platforms. Let’s delve into some of the detailed customer reviews from renowned platforms like the Better Business Bureau, Yelp, ConsumerAffairs, and TrustPilot.com.

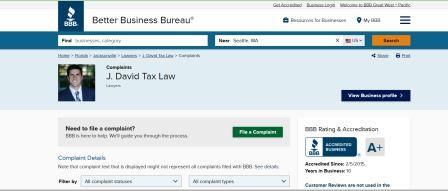

Reviews by Better Business Bureau (BBB)

The Better Business Bureau (BBB) is a trusted platform for evaluating businesses based on customer feedback and overall service quality. J. David Tax Law holds an impressive A+ rating with the BBB, a testament to their commitment to ethical business practices and client satisfaction. Clients frequently commend the firm for its transparency, professionalism, and effective communication throughout the resolution process.

Recent Customer Reviews on BBB:

- John M. expressed his gratitude towards J. David Tax Law for helping him resolve a complex tax issue that had been lingering for years. He praised the firm’s attorneys for their diligence and clear communication, noting that they were always available to answer his questions and guide him through each step of the process. John felt a tremendous sense of relief after the firm successfully negotiated a significant reduction in his tax debt.

- Mary S. shared her experience of dealing with an IRS audit that she had been dreading for months. She highlighted how J. David Tax Law not only represented her during the audit but also took the time to explain the intricacies of the process. Mary was impressed with the firm’s ability to secure a favorable outcome, which resulted in her owing far less than initially anticipated.

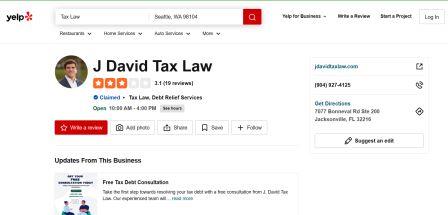

Reviews by Yelp

On Yelp, clients have shared their experiences with J. David Tax Law, emphasizing the firm’s ability to handle complex tax issues efficiently and with a personal touch. Many reviews note the attorneys’ responsiveness and willingness to go the extra mile to ensure favorable outcomes. This feedback underscores the firm’s dedication to providing high-quality legal representation.

Recent Customer Reviews on Yelp:

- Kevin L. described how he was overwhelmed with tax debt and didn’t know where to turn. After contacting J. David Tax Law, he was immediately put at ease by the professionalism and empathy of their attorneys. Kevin appreciated how the firm tailored a plan specifically for his financial situation, ultimately leading to a settlement that saved him thousands of dollars. He noted that the firm’s consistent communication made him feel supported throughout the entire process.

- Laura P. praised J. David Tax Law for their thorough approach to resolving her tax lien issues. She had previously worked with another tax relief company that left her feeling uncertain and stressed. However, her experience with J. David Tax Law was completely different. Laura was particularly impressed with how the firm’s attorneys took the time to understand her unique situation and provided a solution that protected her assets while resolving the lien.

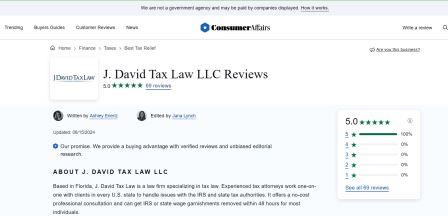

Reviews by ConsumerAffairs

ConsumerAffairs provides a platform for consumers to share their experiences with various services, including legal representation. J. David Tax Law has garnered favorable reviews on this platform, with clients praising the firm’s knowledgeable attorneys and their ability to deliver positive results. The firm’s reputation for achieving successful outcomes is a recurring theme in these testimonials.

Recent Customer Reviews on ConsumerAffairs:

- Robert T. shared his story of how J. David Tax Law helped him resolve a tax issue that had been haunting him for years. He appreciated the firm’s straightforward approach and how they kept him informed at every stage of the process. Robert was particularly thankful for the way the attorneys at J. David Tax Law handled his case with care and professionalism, ultimately leading to a resolution that exceeded his expectations.

- Angela R. wrote about her experience dealing with unfiled tax returns that had accumulated over several years. She was initially overwhelmed by the potential penalties and liabilities, but J. David Tax Law’s attorneys reassured her and took charge of the situation. Angela was impressed with the firm’s efficiency and the personalized attention she received, which made a daunting process much more manageable.

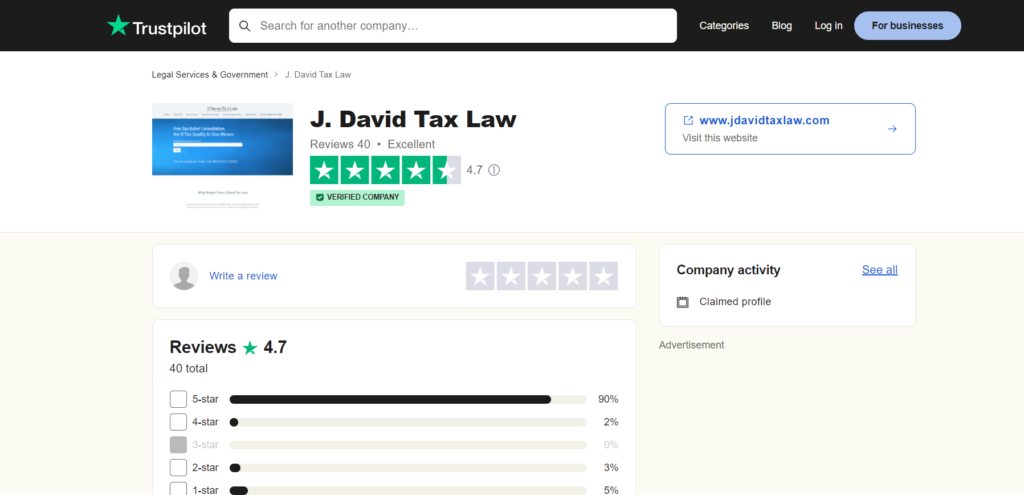

Reviews by TrustPilot.com

TrustPilot.com offers insights into customer experiences across various industries, and J. David Tax Law has received commendations on this platform for its knowledgeable staff and effective strategies in resolving tax disputes. Clients on TrustPilot appreciate the firm’s commitment to helping them understand their options and navigate the complexities of tax law.

Recent Customer Reviews on TrustPilot:

- Steven G. highlighted the exceptional service he received from J. David Tax Law, particularly during a time when he felt overwhelmed by a tax audit. He commended the firm for their strategic approach and the way they kept him informed throughout the entire process. Steven was particularly impressed with the firm’s ability to negotiate with the IRS on his behalf, resulting in a much more favorable outcome than he had anticipated.

- Emily W. shared her positive experience with J. David Tax Law after they helped her navigate a complex tax situation involving both federal and state taxes. She appreciated the firm’s transparency and the way they clearly outlined her options from the start. Emily was also grateful for the continuous support and guidance she received from the attorneys, which helped her resolve her tax issues with minimal stress.

Real-Life Examples of Success

The success of J. David Tax Law can be seen in the real-life stories of clients who have overcome significant tax challenges with the firm’s help. These examples illustrate the firm’s commitment to achieving positive outcomes for its clients.

- Sarah’s Story: Sarah, a small business owner, faced a hefty tax debt after a difficult year in her business. Overwhelmed and unsure of her options, she contacted J. David Tax Law. The firm’s attorneys meticulously reviewed her case and negotiated a favorable settlement with the IRS, significantly reducing her tax burden. Sarah was able to regain financial stability and continue running her business without the weight of overwhelming debt.

- Mark’s Experience: Mark was facing an IRS audit that threatened to impose substantial penalties. Unsure of how to proceed, he sought the assistance of J. David Tax Law. The attorneys at the firm provided comprehensive representation throughout the audit process, ensuring that Mark’s rights were protected. Thanks to their expertise, the audit concluded with Mark owing significantly less than initially anticipated, allowing him to move forward with peace of mind.

Let’s Summarize…

In summary, J. David Tax Law stands out as a reliable partner for individuals and businesses facing complex tax challenges. Their team of experienced IRS tax attorneys offers personalized service, ensuring that clients receive the attention and expertise they need. With positive reviews across various platforms, the firm has established a strong reputation for achieving favorable outcomes for its clients.

Frequently Asked Questions

Q: What services do IRS tax attorneys provide?

A: IRS tax attorneys offer legal representation, tax planning, negotiation of settlements, and assistance with audits.

Q: Why should I hire J. David Tax Law?

A: J. David Tax Law provides personalized service from experienced tax attorneys who understand the complexities of tax law and can effectively advocate for your interests.

Q: How can I find reviews for J. David Tax Law?

A: You can find reviews on platforms such as the Better Business Bureau, Yelp, ConsumerAffairs, and TrustPilot.com, where clients share their experiences.

Disclaimer:

The information provided in this blog is for general informational purposes only and does not constitute legal, tax, or financial advice. Every tax situation is unique, and laws and regulations can change. It is important to consult with a qualified tax attorney or financial advisor to obtain advice tailored to your specific circumstances. J. David Tax Law does not guarantee any specific outcome, as results may vary based on individual cases and circumstances. The reviews and testimonials mentioned are based on customer experiences and may not represent typical results. Always seek professional guidance before making any decisions related to tax matters.

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers

сео продвижение сайта цена

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.